ACO BANK

A Bank that challenges the complexity of big Banks to give power back to the people.

In today’s fast-paced world, no one has time for complicated banking. From managing money to getting a loan, making transfers, or paying bills, it should all be simple, fast, and fair. At Aco, we believe a bank should be a place of trust, where every customer’s day runs smoothly, without unnecessary costs or complications.

Research

I conducted a research study with 10 participants aged between 18 and 60 to understand the challenges they face in their day-to-day use of banking apps. The key findings are summarised below.

1. Technical issues

-

App freezing or running slowly.

-

Connection errors even with a stable internet connection.

-

Bugs in specific features as transfers or bill payments not completing.

-

Lack of compatibility with certain phone models or OS versions.

2. Usability issues

-

Cluttered or confusing interface, making it hard to find basic functions.

-

Too many steps to complete common transactions.

-

Use of complex financial or technical terms.

-

Important features hidden in poorly organised menus.

3. Security concerns

-

Fear of scams through phishing or fake apps.

-

Worries about data leaks and banking information being exposed.

-

Authentication processes that are either overly complicated or too weak.

-

Delayed notifications for account transactions.

4. Overall experience

-

Lack of quick customer support through the app, chat or phone.

-

Unclear or restrictive transaction limits.

-

Difficulty resolving issues without visiting a branch.

-

Little to no personalisation as shortcuts to frequently used features.

Priority Matrix

I created a priority matrix to transform raw problems into actionable priorities, ensuring that I am addressing the most impactful challenges first while keeping both users and the business in mind.

UX + Business

Time to align user needs and what makes their experience smooth, safe, and satisfying, with business needs and what the company wants to communicate and achieve through the app.

Persona

When designing the ACO Banking App, it was essential to clearly define who the end users are and what their specific needs, motivations, and challenges look like in real life. To achieve this, I created two distinct user personas that represent key segments of our target audience.

Personas are not just fictional characters; they are strategic design tools that help us empathise with users, anticipate their behaviours, and ensure that every feature we develop aligns with real expectations. By outlining their goals, frustrations, and desired experiences, we can bridge the gap between user needs and business objectives.

The two personas developed for this project capture very different, yet equally important, types of banking users:

-

Emily, a young digital native who demands speed, flexibility, and seamless integration in her financial life.

-

Richard, a mature user who values clarity, trust, and an intuitive experience that simplifies his daily banking tasks.

Creating these profiles allows us to design a Banking App that is inclusive, effective, and user centred, ensuring that ACO Bank not only meets functional requirements but also builds trust and loyalty across generations.

Wireframing & Usability Testing

By analysing user needs through personas and mapping them against company benefits, I developed solutions that are not only functional but also impactful for both sides.

The following wireframes demonstrate how these insights translate into concrete design decisions, showing clear pathways where problems meet solutions and user needs align with business objectives.

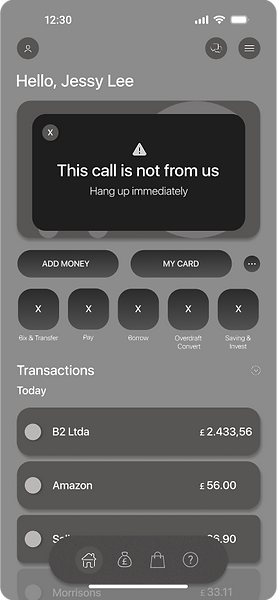

Security & Scam Protection

One of the most common ways criminals attempt to defraud banking customers is through phone scams, where attackers impersonate the bank to trick users into sharing sensitive information. Many people, especially those who are less tech-savvy, struggle to distinguish between a legitimate call and a fraudulent one.

To reduce this risk, the app introduces a real-time security alert: whenever a suspicious or non-verified number attempts to call the user claiming to be the bank, a clear message appears on the phone screen stating: “This call is not from us. Hang up immediately.”

Secure Bank: Easy, Quick, and Intuitive Onboarding

Creating a Secure Bank account should not be complicated or intimidating. With Secure Bank, the onboarding process is designed to be accessible to everyone, from digital natives to first-time mobile banking users, while maintaining the highest security standards.

Based on user feedback, I redesigned key screens and iterated on the product by adding valuable features and removing those that did not meet user needs.

Intuitive User Flow

To give users fast support and build trust, the app integrates a direct chat feature that makes it simple to reach the bank whenever help is needed.

Quick

Instant access to support without waiting on phone lines.

Easy

Clear entry point from the home screen, just one tap away.

Intuitive

Simple interface with guided options (FAQ, connect with an agent, request a callback).

Quick "Chat with us"

Intuitive way to pay

My card

Prototyping